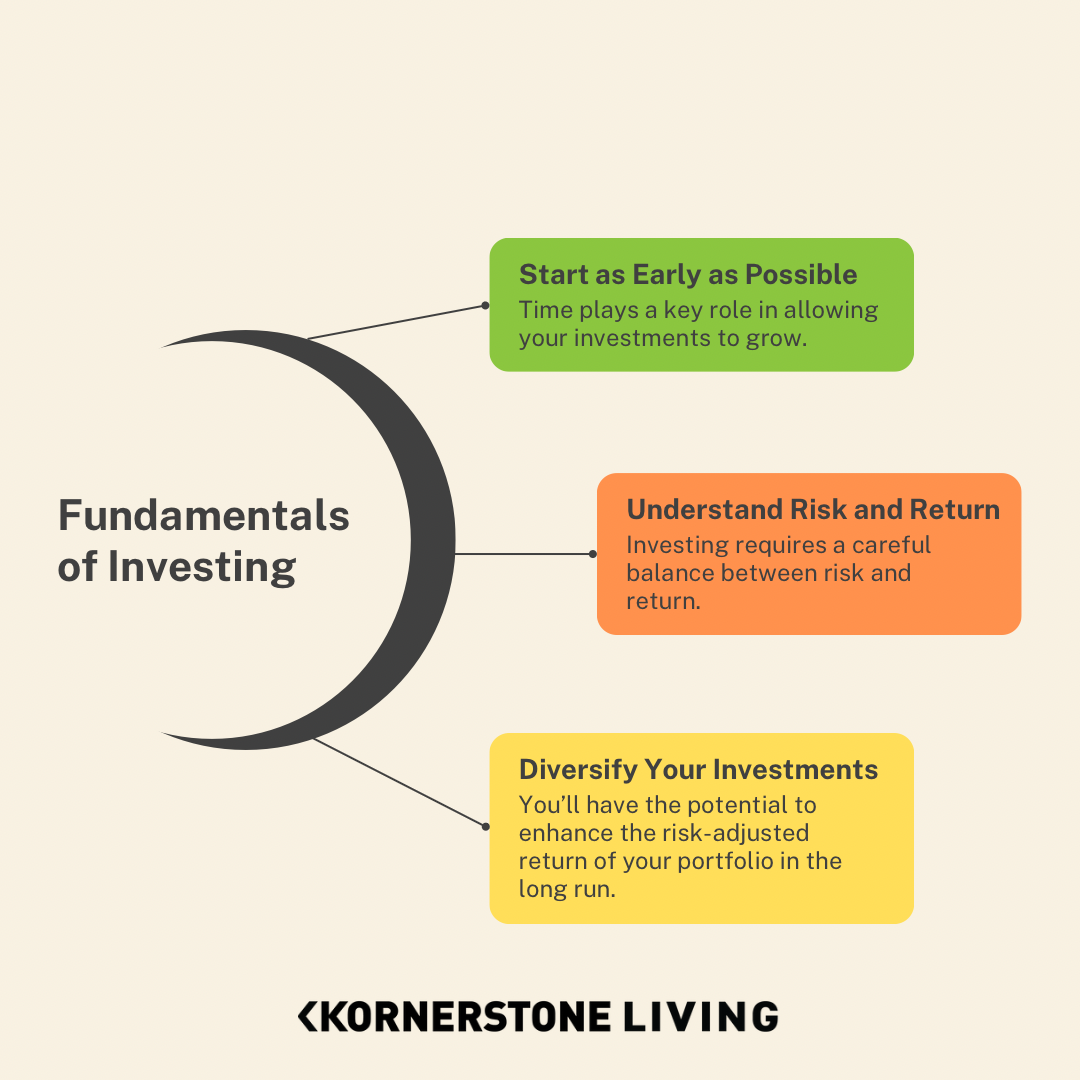

When starting out, investing may feel overwhelming, but it's a crucial step toward securing your financial future and reaching your long-term goals. Whether you're planning for retirement, a home, or simply aiming to grow your wealth, grasping the fundamentals of investing is key. Here are three essential points that every novice should understand:

1. Start as Early as Possible: Harness the Power of Time

One crucial aspect of investing is the advantage of starting early, and it's never too late to begin. Time plays a key role in allowing your investments to grow through compound interest, where not only does your initial investment earn interest, but the interest itself also earns interest over time.

For instance, if you decide to invest $1,000 and achieve a 7% annual return, after one year, you would see your investment grow to $1,070. In the following year, you would then earn 7% on the increased amount of $1,070 rather than just the original $1,000. Over time, this compounding effect has the potential to significantly boost your initial investment..

2. Understand Risk and Return

Investing requires a careful balance between risk and return. Typically, investments with greater potential for returns also come with higher levels of risk. For example, stocks historically offer higher long-term returns compared to bonds or savings accounts, but they also come with increased volatility.

It's crucial to evaluate your own risk tolerance before diving into investments. For younger investors with a longer time horizon, taking on more risk can often be manageable as there is ample time to recover from market downturns. However, as you approach the point of needing the funds, such as for retirement, it might be prudent to transition towards more conservative options like bonds or high-yield savings accounts.

3. Diversify Your Investments

Diversification is a strategic approach that involves spreading your investments across various asset classes (such as stocks, bonds, real estate, etc.) and within each asset class (different industries, geographies, etc.). The primary aim of diversification is to mitigate the risk of your overall portfolio. In the event that one investment under-performs, others may outperform and help mitigate potential losses.

By diversifying your investments, you have the potential to enhance the risk-adjusted return of your portfolio in the long run. This approach is often encapsulated in the wise saying, "Don't place all your eggs in one basket."

In Summary

Investing is a fantastic opportunity for everyone, regardless of wealth or financial knowledge. It's a valuable path towards reaching your financial goals and growing your wealth over time. By starting early, understanding the balance between risk and return, and diversifying your investments, you can pave the way for a more stable financial future. Remember, successful investing isn't about timing the market but about spending time in the market. Start today, even with small amounts, and let the power of compound interest work in your favor. Happy investing!

Disclaimer: Not Financial Advice

The content provided in this blog is for informational purposes only and should not be construed as financial advice. The author of this blog is not a financial advisor and does not provide personalized financial guidance.

All investment and financial decisions you make are solely your responsibility. It is important to conduct thorough research and/or consult with a qualified financial advisor before making any investment decisions.

The information presented in this blog may not be suitable for your individual circumstances or financial goals. Any reliance you place on the information provided is at your own risk. The author does not guarantee the accuracy, completeness, or reliability of any information or opinions shared.

Investing involves risks, including the potential loss of principal. Past performance does not guarantee future results.

Always consider your own financial situation, risk tolerance, and investment objectives before making any decisions. If you require personalized financial advice, please seek the counsel of a certified financial planner or advisor who can provide guidance tailored to your specific needs.

By accessing and reading this blog, you acknowledge and agree that the author is not liable for any direct or indirect damages or losses arising from the use of or reliance on the information provided herein.

Comments